Under the Patient Protection and Affordable Care Act (PPACA) a new fee was introduced. The Patient-Centered Outcomes Research Institute (PCORI) fees for self-insured plans are a mandatory charge due by July 31st of the year following the last day of the policy year. It’s reported on IRS Form 720.

PCORI Fees for Self-Insured Plans

Mar 31, 2025 4:19:48 PM / by Blake Erickson posted in Employee Benefits

The PFAS Challenge: Risk Management in the Age of Strict Regulation

Mar 31, 2025 4:19:36 PM / by Taylor Virgil posted in Business Insurance

Per- and polyfluoroalkyl substances (PFAS) have emerged as a significant concern due to their widespread use in consumer goods, leading to exposure to potential health and environmental hazards. The rise in PFAS-related challenges has prompted interest in comprehending their influence on insurance and claims. This article takes a closer look at PFAS regulation in the United States, discusses PFAS-related insurance matters and claims, and highlights emerging trends. We also provide strategic guidance for businesses to manage risks associated with PFAS.

National Cybersecurity Awareness Month 2022

Mar 31, 2025 4:19:19 PM / by Matt Jensen posted in Business Insurance

October is National Cybersecurity Awareness Month. During this annual event, government and industry leaders come together to raise awareness about the importance of cybersecurity.

Artificial intelligence, or AI, is transforming the insurance industry, leading the way in revolutionizing tasks that were traditionally performed by humans, such as visual perception, speech recognition, decision making, and language translation. Virtual assistants such as Alexa and Siri are familiar examples of how artificial intelligence (AI) is used in everyday life, capable of performing tasks like calling a contact, setting an alarm, or playing a song through simple voice commands. By utilizing AI in Insurance, the industry is witnessing a profound transformation, leveraging technology to meet evolving customer needs and redefine the standards of service and efficiency.

Why Directors and Officers Need Personal D&O Insurance

Mar 31, 2025 4:19:04 PM / by Taylor Virgil posted in Business Insurance

Most organizations recognize the vital role directors and officers play in steering their companies toward success. With this responsibility comes significant risk, making Directors and Officers (D&O) insurance an essential safeguard. D&O coverage comes in many shapes and sizes depending on the number of companies, boards, and activities that executives are involved in. Here, we’ll explore the key aspects of D&O insurance and discuss why personal D&O insurance is crucial, especially for those serving on multiple boards.

Utilizing the SBA Surety Bond Program

Mar 31, 2025 4:18:54 PM / by Damien Strohmier posted in Surety

With bonded work on the horizon for a new or growing company, owners may be wondering how they can get started and what programs are available for these initial bond needs, especially regarding surety bonds for contractors.

Essential Strategies for Active Shooter Preparedness

Mar 31, 2025 4:18:40 PM / by Steve Stetson posted in Safety Consulting

In today’s unpredictable world, ensuring the safety of your employees and colleagues has become a top priority for businesses and organizations of all sizes. One crucial aspect of workplace safety that cannot be overlooked is active shooter awareness training. In this blog post, we’ll delve into the significance and share some effective active shooter training tips, highlighting why this training is essential for both businesses and individuals.

Cyber Awareness Month: Insights for Insurance Buyers

Mar 31, 2025 4:18:33 PM / by Taylor Virgil posted in Business Insurance

Welcome to Cyber Awareness Month! The theme for 2023 is “It’s easy to stay safe Online.” At DSP Insurance Services, we understand the challenges that the ever-evolving digital world poses. Especially to insureds seeking to navigate this complex landscape. This month is pivotal for those looking to bolster their understanding of cyber threats and protections,

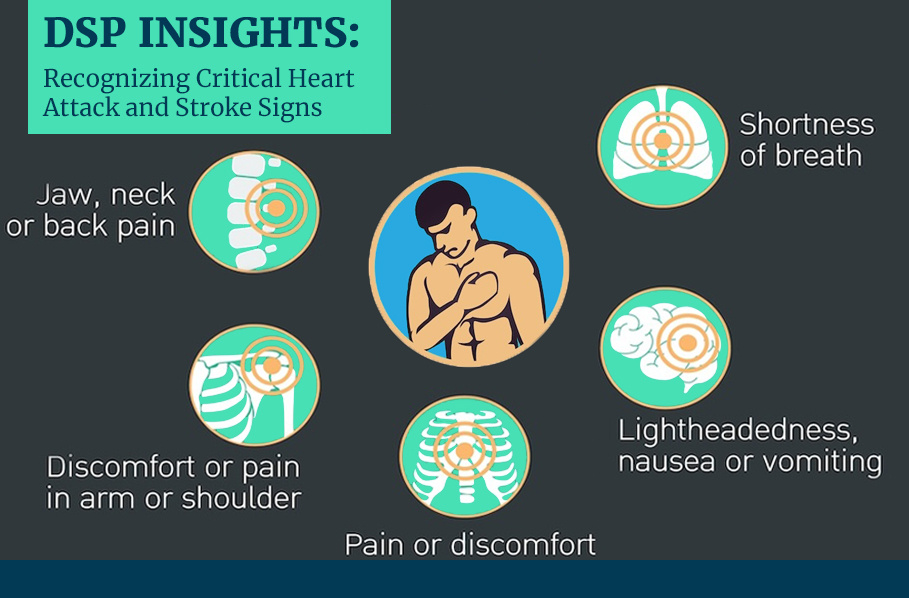

Recognizing Critical Heart Attack and Stroke Signs

Mar 31, 2025 4:17:40 PM / by Steve Stetson posted in Safety Consulting

Recognizing the signs and symptoms of a heart attack or stroke is crucial for timely intervention and potentially life-saving action.

Partnering with a CPA Firm and Bank for Construction Success

Mar 31, 2025 4:17:33 PM / by Damien Strohmier posted in Surety

In the world of construction, navigating the financial landscape requires more than just basic accounting and banking services. Construction firms face unique challenges and opportunities, making it crucial to partner with a both a CPA firm and bank with significant construction experience. These specialized service providers understand the nuances of construction accounting and financial reporting, the allowable income recognition methods for small contractors, and the industry’s volatile nature. Here’s why these partnerships are essential for your firm’s success.