The IRS has announced new inflation-adjusted limits for flexible spending accounts (FSAs) beginning in 2026, giving employees more room to set aside pre-tax dollars for medical and dependent care expenses. These updates, along with a major legislative change from the One Big Beautiful Bill (OBBB) Act, make 2026 an important year for benefit planning. For employees, these changes translate to greater flexibility and potential tax savings. For employers, they mean updated plan limits, new communication needs, and an opportunity to highlight valuable benefits.

IRS Increases Health and Dependent Care FSA Limits for 2026

Nov 5, 2025 1:47:55 PM / by Eric Vatch posted in Employee Benefits

Fireplace and Fire Pit Safety: Keeping Warm the Right Way

Oct 15, 2025 1:35:32 PM / by Laura Wywial posted in Personal Insurance

When temperatures drop, there’s nothing like the comfort of a warm fire, whether it’s in your living room or out in the backyard. Fireplaces, wood stoves, and fire pits can create cozy moments and great memories, but they also come with responsibilities. A few simple precautions can help prevent accidents and keep your home, family, and guests safe.

Employee Benefits That Work for Early Childhood Education

Oct 10, 2025 1:30:22 PM / by Blake Erickson posted in Employee Benefits

Running a school is hard work. Every dollar matters. Every staff member matters even more.

In early childhood education, whether practiced like Montessori, Waldorf or others, benefits are not just a nice-to-have. They are the difference between keeping great teachers and losing them to other jobs. The right benefits strategy helps you manage costs, keep your people, and give families the consistency they expect.

Carbon Monoxide Safety: Protecting Your Home and Family

Oct 1, 2025 3:40:56 PM / by Steve Stetson posted in Safety Consulting

Carbon monoxide (CO) is a silent, odorless, and colorless gas that can be deadly if not detected early. Often called the "invisible killer," it’s produced by burning fuels like gas, wood, charcoal, or oil in devices such as heaters, stoves, or vehicles. Understanding CO risks and taking preventive measures can save lives. Here’s what you need to know to stay safe.

WIP and CC Schedules Matter for Surety Support

Sep 24, 2025 12:34:41 PM / by Damien Strohmier posted in Surety

In the construction industry, accurate financial reporting is more than a compliance requirement, it is the foundation of trust with surety partners. Among the most critical components of contractor financials are the Work in Process (WIP) schedule and the Completed Contracts (CC) schedule. These schedules do more than just list projects; they provide visibility into the accuracy of job costing, estimating practices, and overall financial health of the business.

Insurance Fraud: How It Impacts Your Business

Sep 18, 2025 12:53:54 PM / by Mike Pohl posted in Commercial Lines

Insurance fraud isn’t just an industry problem, it’s a business problem. Fraud costs the U.S. an estimated $308 billion every year, with property and casualty fraud making up nearly $90 billion of that total. Those losses trickle down in the form of higher premiums, stricter terms, and challenges when it comes to securing coverage.

From Paycheck to Protection - Understanding Individual Disability Insurance

Sep 10, 2025 1:58:23 PM / by Eric Vatch posted in Employee Benefits

What Is Individual Disability Insurance?

Disability insurance pays a portion of your income if you cannot work due to an illness or injury. Employer-sponsored plans often have limits on benefits and an “Individual Disability Insurance” (IDI) policy can provide a more comprehensive level of income protection on their own or layered with an employer policy. IDI policies are:

-

Owned by you and stay with you no matter where you work.

-

Fills in the benefit gap an employer plan may have.

-

Typically provides additional benefit enhancements for catastrophic illness/injury.

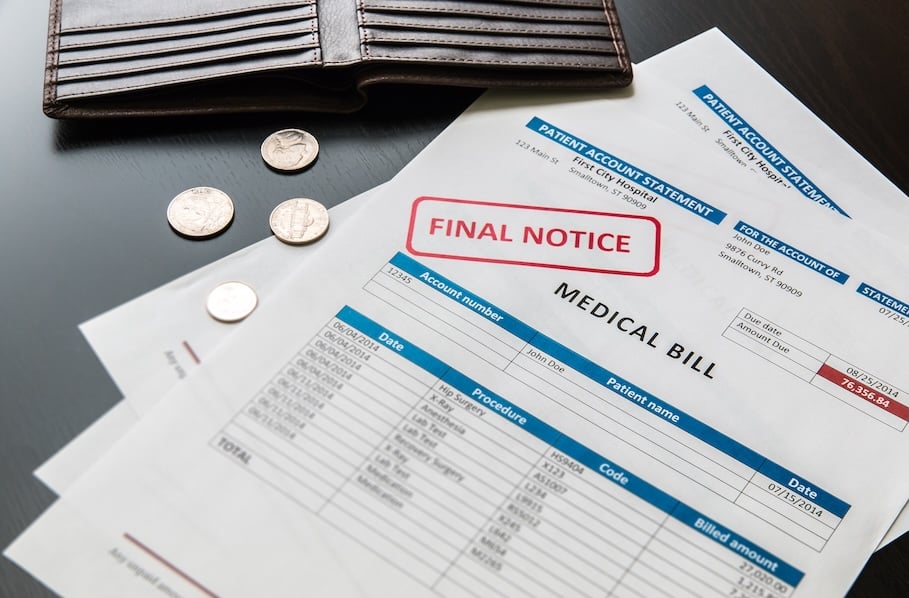

Dear Chicagoland: Stop Paying Hospital Prices for Routine Care

Aug 19, 2025 1:47:02 PM / by Blake Erickson posted in Employee Benefits

If you run payroll anywhere from The Loop to Lake County, you’re paying too much for the same care your people could get safely, often better, outside the hospital campus. Not because you’re careless. Because our market is wired to push routine services into the most expensive settings and then send the bill to employers.

Here’s the blunt version: consolidation plus misaligned incentives = inflated unit prices and the wrong site of care. And it’s costing your plan millions that should be going to wages, growth, and retirement matches...not “facility fees” and parking garages.

Are You Prepared for a Power Outage

Aug 15, 2025 2:22:33 PM / by Laura Wywial posted in Personal Insurance

Power outages can happen without warning, whether it's from a major storm, equipment failure, or something more unpredictable. The good news? With the right preparation, you can minimize the disruption and keep yourself and others safe until the lights come back on.

At DSP Insurance, we believe safety starts before disaster strikes. That’s why we’ve compiled key tips to help you handle power outages with confidence.

Employee Training Programs That Lower Liability Risk and Insurance Premiums

Aug 1, 2025 1:42:07 PM / by Desiree Morris posted in Business Insurance, Commercial Lines

In today’s business environment, a single misstep by an employee can result in significant liability from workplace injuries and harassment claims to data breaches and regulatory fines. Many of these incidents are preventable with proper training.